per capita tax meaning

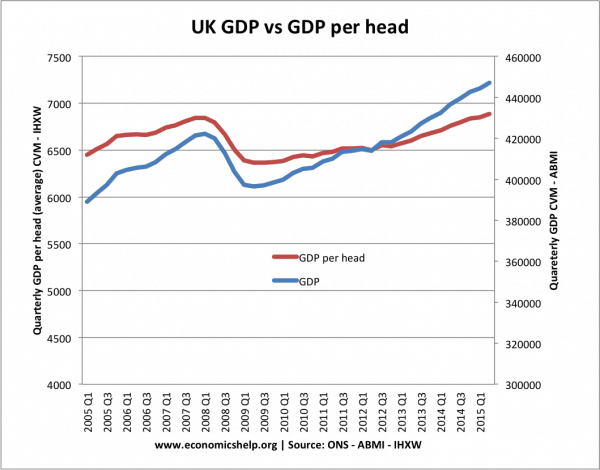

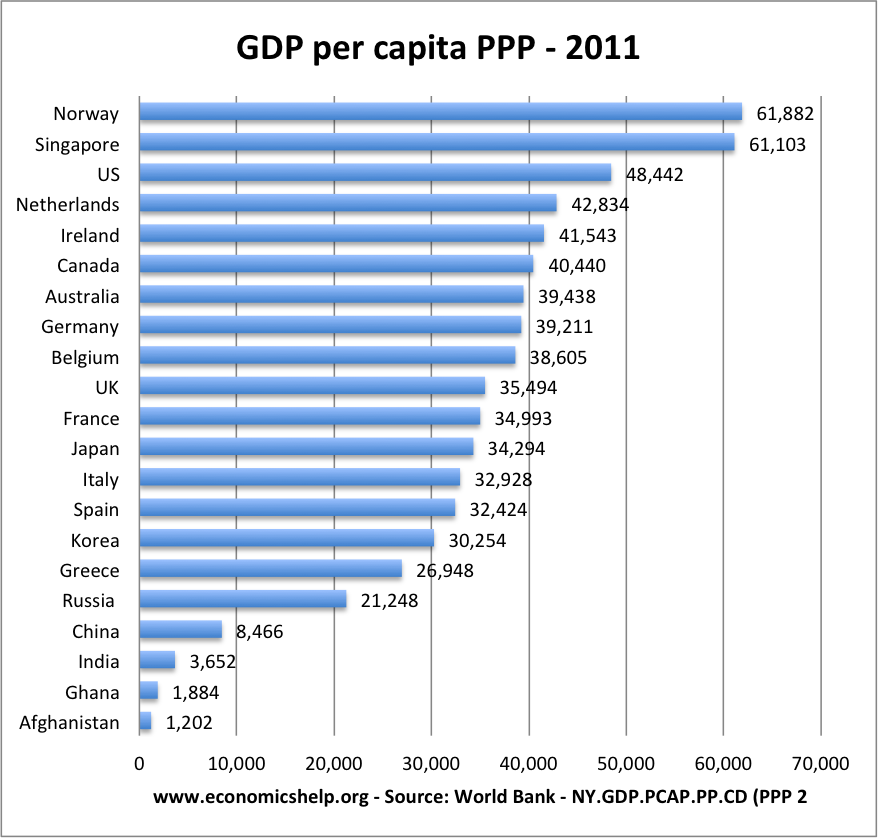

The definition of GDP per capita is when the GDP is divided by the countrys population to show the national breakdown of a countrys economic output in relation to its population. Alaska Florida Nevada South Dakota Tennessee Texas Washington and Wyoming.

Per Capita Definition Formula Examples And Limitations Boycewire

Individual Taxpayers Per Capita Tax FAQ 1.

. Per capita income PCI or total income measures the average income earned per person in a given area city region country etc in a specified year. It means to share and share alike according to the number of individuals. In a per capita distribution an equal share of an estate is given to each heir all of whom stand in equal degree of relationship from.

Net Taxable Income has the meaning set forth in Section 401bi. Per capita also means per person and According to Berkheimer Tax Innovations The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction. Define Net tax per capita.

Local governments rely heavily on property taxes to fund schools roads police. If you dont have a financial advisor yet. Well income per capita is basically the amount of money per person in a specific area.

Per capita distributions might mean for your heirs. More specifically according to the United States Census Bureau it is the money earned by every man woman. In fiscal year FY 2016 the most recent year of data available property taxes generated 315 percent of total US.

Latin By the heads or polls. This was a function of both rate structures and income. How to use per capita in a sentence.

By or for each person. Per capita also means per person and According to Berkheimer Tax Innovations The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction. For most areas adult is defined as 18 years of age and older though in some areas the minimum age may differ.

Under a per capita distribution each person named as beneficiary receives an equal share. The school district as well as the township or borough in which you reside may levy a per capita tax. Property taxes are an important source of revenue for local and state governments.

Per Capita means by head so this tax is commonly called a head tax. Per capita income is often used to measure a sectors average income and compare the wealth. It is calculated by dividing the areas total income by its total population.

It is not dependent upon employment. Determine the number that correlates with what you are trying to calculate. Consider talking to a financial advisor about how to get started with estate planning and what per stirpes vs.

March 9 2022 416 PM. Because it is not payment of prior year local tax feels wrong to report as such. Most taxpayers are whats called calendar year taxpayers.

State and local tax collections and 72 percent of local tax collections. Income per capita is a measure of the amount of money earned per person in a certain area. The main purpose of per capita income to present the average income of a nation is a great tool to manage wealth among nations.

GDP is the gross domestic product or the total financial output of a country. Per capita is the legal term for one of the ways that assets being transferred by your will can be distributed to the beneficiaries of your estate. What is the Per Capita Tax.

The meaning of PER CAPITA is per unit of population. They report income in the year they receive it and deduct expenses in the year paid. When per capita income decreases it allows national.

However the way your will is drawn up and the laws of the state where the will is probated may. Using the ratio explicitly an increase in PCI allows national leaders to realize their prosperity and successful economic initiatives during the year. The Super Bowl tends to feature a few overly patriotic ads each year and General Motors put a fun spin on that tradition by giving Will Ferrell a vendetta against Norway for selling more electric cars per capita than the United States.

Per capita is the legal term for one of the ways that assets being transferred by your will can be distributed to the beneficiaries of your estate. This tax is due yearly and is. Take the following steps to calculate the per capita of a particular situation.

A term used in the Descent and Distribution of the estate of one who dies without a will. Per capita income is national income divided by population size. Per capita distributions could trigger generation-skipping tax for grandchildren or other descendants who inherit part of your estate.

Whether you rent or own if you reside within a taxing district you are liable to pay this tax to the. A Per Capita tax is a flat rate tax equally levied on all adult residents within a taxing district. Information About Per Capita Taxes.

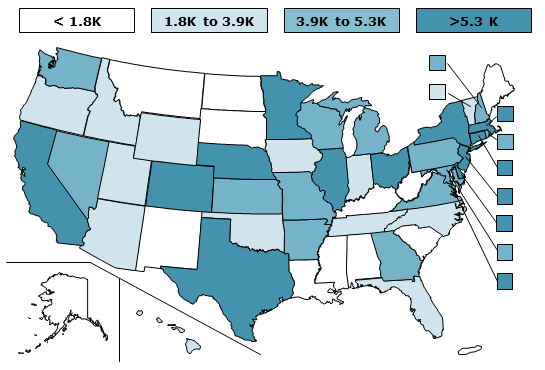

On average state and local governments collected 1303 per capita in individual income taxes but collections varied widely from state to state. For example if you want to know how many people have blue hair per every X amount of people in a certain population you would first. If you paid your per capita tax in 2021 then it is a 2021 deduction.

Means the adjusted net tax capacity of all taxable real property in the city or town or county divided by the total population of that city town or county. Per capita Unit Number of people in a population. In all eight states forgo an individual income tax.

Do I pay this tax if I rent. This is an especially useful financial indicator because it gives economists a. Low levels of GDP per capita and the need to boost economic growth also push Governments to limit the tax burden on the private sector thus making use of tax exemptions and holidays.

Per Capita Tax is a tax levied by a taxing authority to everyone over 17 years of age residing in their jurisdiction. UN-2 Estimated at 105 of income North Carolinas state and local tax burden percentage ranks 23rd highest nationally taxpayers pay an average of 3526 per. It can apply to the average per-person income for a city region or country and is used as a means of.

Tax Burden By State In 2022 Balancing Everything

Real Gdp Per Capita Economics Help

Real Gdp Per Capita Economics Help

Income Per Capita Economy Provincial Rankings How Canada Performs

Property Tax Definition Property Taxes Explained Taxedu

What Does Per Capita Payroll Mean

Per Capita Income Calculation Examples What Is Per Capita Income Video Lesson Transcript Study Com

Property Tax Definition Property Taxes Explained Taxedu

Key Aspects Of Per Capita Personal Income

Income Per Capita Economy Provincial Rankings How Canada Performs

Information About Per Capita Taxes York Adams Tax Bureau

India National Income Per Capita 2022 Statista

Federal Reserve Bank Of San Francisco Taxes Transfers And State Economic Differences

State Local Property Tax Collections Per Capita Tax Foundation

Tax Structure Tax Base Tax Rate Proportional Regressive And Progressive Taxation

/GettyImages-545863985-e964b845dce944dfb2b94153aab83a7a.jpg)